An Unbiased View of Tax Planning copyright

Table of ContentsRetirement Planning copyright Things To Know Before You Get ThisAn Unbiased View of Retirement Planning copyrightSome Ideas on Retirement Planning copyright You Should KnowThe Greatest Guide To Investment ConsultantTop Guidelines Of Lighthouse Wealth ManagementIndicators on Investment Representative You Should Know

“If you were to purchase something, state a tv or a computer, might want to know the specs of itwhat tend to be its components and what it may do,” Purda details. “You can think about getting monetary guidance and assistance in the same way. Individuals have to know what they are buying.” With monetary information, it's important to understand that the merchandise is not ties, stocks and other financial investments.

it is such things as cost management, planning retirement or reducing debt. And like getting a personal computer from a dependable organization, customers want to know they might be buying monetary information from a dependable specialist. One of Purda and Ashworth’s most fascinating conclusions is about the fees that economic coordinators demand their customers.

This presented correct no matter the cost structurehourly, fee, possessions under control or predetermined fee (inside the learn, the dollar property value charges had been similar in each situation). “It nonetheless relates to the worth proposal and doubt throughout the consumers’ part they don’t know very well what these are generally getting back in trade for those charges,” says Purda.

The Best Guide To Independent Investment Advisor copyright

Hear this post When you hear the phrase economic specialist, just what pops into the mind? A lot of people think about a professional who is able to provide them with monetary information, particularly when considering spending. That’s an excellent starting point, although it doesn’t decorate the photo. Not even near! Monetary experts might help people with a bunch of additional money goals too.

A financial specialist assists you to create wide range and protect it for your long haul. Capable calculate your future monetary requirements and plan approaches to extend your own your retirement savings. They could additionally advise you on when you should start tapping into personal Security and using the money inside retirement records so you're able to abstain from any terrible charges.

Getting My Private Wealth Management copyright To Work

They can let you ascertain exactly what common funds tend to be right for you and show you simple tips to handle and then make more of your financial investments. Capable additionally help you comprehend the risks and exactly what you’ll need to do to produce your targets. A practiced expense professional can also help you remain on the roller coaster of investingeven when your investments just take a dive.

They could provide assistance you will need to make a strategy to ensure that your wishes are executed. While can’t put a cost label regarding comfort that accompany that. Per research conducted recently, the average 65-year-old couple in 2022 should have around $315,000 saved to pay for medical care prices in retirement.

How Tax Planning copyright can Save You Time, Stress, and Money.

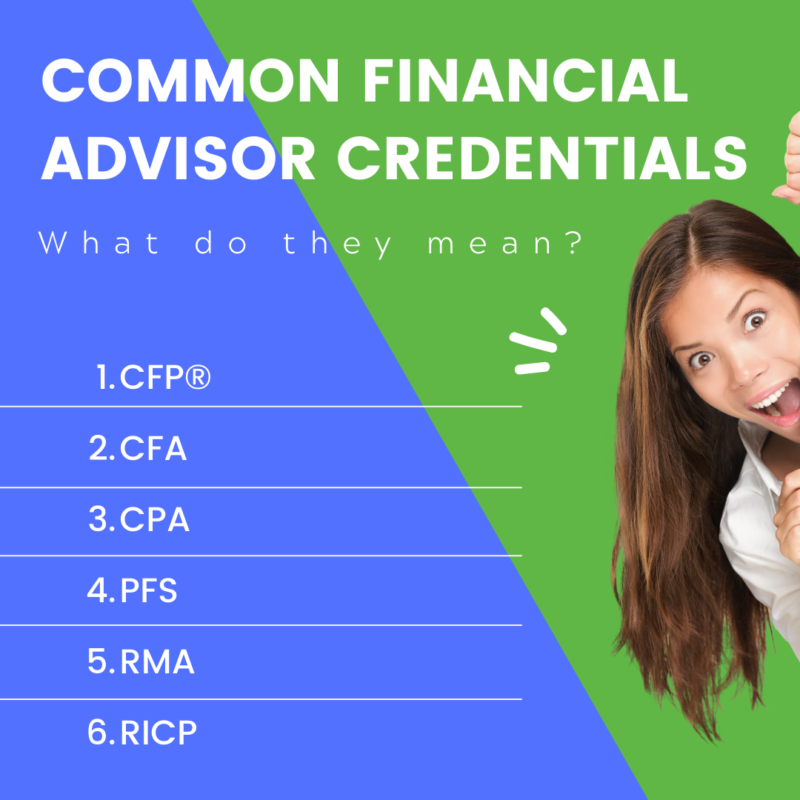

Now that we’ve gone over just what monetary advisors carry out, let’s dig inside differing types. Here’s a guideline: All economic coordinators tend to be economic experts, not all analysts tend to be planners - https://www.blogtalkradio.com/lighthousewm. A monetary planner centers on assisting individuals make intends to attain long-lasting goalsthings like beginning a college fund or preserving for a down cost on a house

How do you understand which monetary consultant is right for you - https://allmyfaves.com/lighthousewm?tab=Lighthouse%20Wealth%20Management%2C%20a%20division%20of%20iA%20Private%20Wealth? Here are some activities to do to make certain you’re hiring the proper person. What do you do once you have use this link two bad choices to pick? Effortless! Get A Hold Of even more possibilities. The greater choices you've got, the much more likely you're in order to make good choice

The Only Guide for Lighthouse Wealth Management

The wise, Vestor program can make it simple for you by revealing you doing five financial experts who is going to serve you. The best part is actually, it's completely free attain associated with an advisor! And don’t forget to come quickly to the meeting ready with a list of concerns to inquire of in order to determine if they’re a good fit.

But listen, just because a consultant is smarter than the average keep does not let them have the authority to let you know what direction to go. Occasionally, experts are loaded with themselves since they do have more levels than a thermometer. If an advisor starts talking-down for your requirements, it’s for you personally to suggest to them the door.

Keep in mind that! It’s important that you plus economic consultant (whoever it ends up becoming) are on the same web page. Need a specialist that a lasting investing strategysomeone who’ll promote you to definitely hold trading consistently perhaps the market is up or down. independent investment advisor copyright. You additionally don’t want to use an individual who pushes you to definitely invest in a thing that’s as well risky or you are not comfortable with

The Best Guide To Retirement Planning copyright

That blend gives you the diversification you should successfully invest when it comes to longterm. Whilst study economic advisors, you’ll most likely come across the word fiduciary duty. All this work suggests is actually any consultant you employ must act such that benefits their own client and not unique self-interest.

Comments on “Retirement Planning copyright for Dummies”